What is a Cryptocurrency Exchange and How Does it Function?

A cryptocurrency exchange is a website where users buy, sell, and trade cryptocurrency. Consumers can deposit fiat currency (such as US dollars) and use that cash to acquire cryptocurrency on cryptocurrency exchanges, which operate similarly to digital brokerages. Consumers can also exchange their cryptocurrency for other cryptocurrencies, and some exchanges allow them to generate a profit on assets held in their account statements.

What Factors Should You Consider When Selecting a Cryptocurrency Exchange?

There are many factors to take into account when selecting a cryptocurrency exchange, including

- Safety

- Fees

- Cryptocurrencies Availablity.

It is also essential to understand how your cryptocurrency is kept and whether you can take possession of it by transmitting it to your digital wallet.

How Can You Purchase Cryptocurrency?

To buy cryptocurrency, most centralized exchanges accept deposits from your bank account, credit card, or debit card. The resources can then be exchanged for the cryptocurrency of your choice. Although some exchanges only accept simple market orders, others specify more advanced order types, such as threshold and stop orders.

How Do You Open a Bitcoin Exchange Account?

Often these digital currencies enable you to provide your name, email address, private details, and form of identification to set up an account (to follow KYC standards). This procedure may also include responding to personal questions, using a third-party application to confirm your identity, or offering a picture of your driver’s license.

You can transfer finances and use your account once it has been accepted.

Best Crypto Exchanges 2023:

Here is the list of 15+ Best Crypto Exchanges in 2024.

- Coinbase

- Crypto.com

- Gemini

- BitMart

- Kraken

- Cash App

- Bisq

- BlockFi

- Binance

- Uphold

- eToro

- Bitcoin IRA

- Hodlnaut

- Abra

- CEX.IO

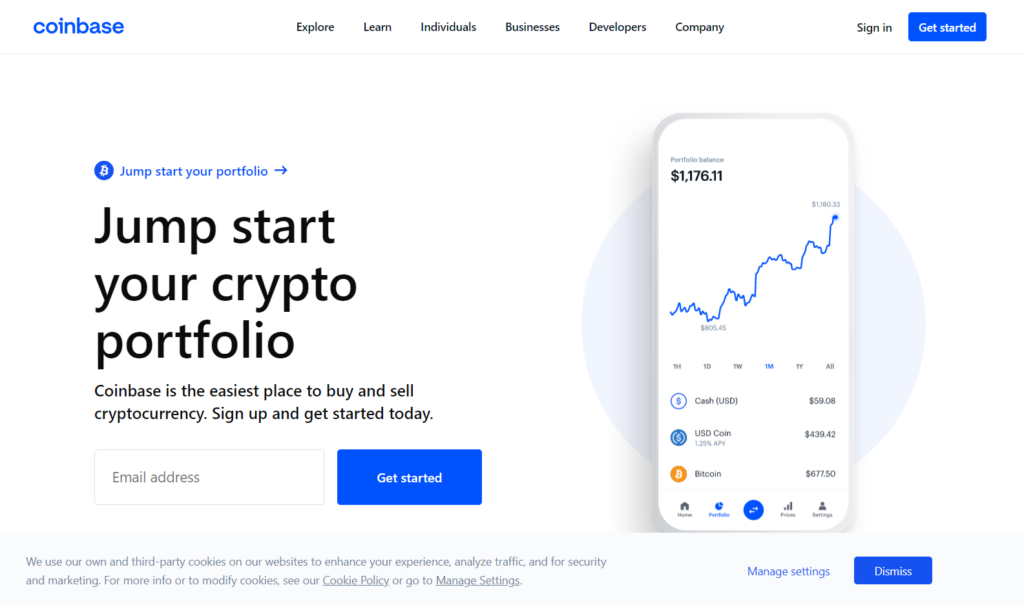

1. Coinbase:

Coinbase was established in 2012 to make it easier for people to purchase, sell, and store Bitcoin. Presently, Coinbase is a publicly traded cryptocurrency exchange with total revenue of more than $36 billion.

The cryptocurrency exchange, which was founded in San Francisco, is now a geographically decentralized corporation with no head office and operations in over 100 countries. It distinguishes itself by offering a user-friendly trading history, strong security, and a variety of additional features for professional ones.

Coinbase has become the go-to exchange for many first-time crypto buyers owing to its huge number of endorsed investments (150+) and simple framework. The system has the appearance and feel of an online banking app, which most people are already familiar with, making the transition to cryptocurrency investing simple.

While Coinbase is a good exchange for both new and experienced crypto investors, trading fees can be generally high and tend to range from 0% to 0.60 % based on trade volume.

Pros:

- A significant number of cryptocurrencies and trading pairs are available.

- Provides both newcomer and enhanced trading systems

- Extremely liquid exchange

Cons:

- There is a lack of high-quality customer support.

- Coinbase.com is a custodial account, which means you do not have access to the private keys.

2. Crypto.com:

Crypto.com, which was founded in 2016, has formed itself as one of the world’s leading cryptocurrency exchanges. It is now accessible in 90 countries and accepts over 250 cryptocurrencies.

In addition to a variety of endorsed assets, Crypto.com offers a vast technology platform ecosystem that includes its blockchain, Crypto.org Chain; a native token called CRO; a crypto visa card; yield-generating crypto items, and much more.

The Crypto.com mobile app, on the other hand, stands out. While many crypto exchange mobile apps can provide a watered-down edition of the exchange’s web-based forum, Crypto.com focused heavily on developing an app that provides a wide variety of products and attributes, allowing customers to earn from the exchange’s ecosystem while on the go. Users of the mobile app can buy, sell, trade, and earn interest on their cryptocurrency, as well as pay with it.

While Crypto.com has a large number of products and features, customer service is lacking, according to Trustpilot findings from former and present clients who end up leaving poor reviews. Furthermore, except if you trade in large volumes, you will be subject to relatively high trading costs of up to 0.40 percent.

Pros:

- Accepts over 250 cryptocurrencies

- Offers a variety of cryptocurrency product lines

Cons:

- Fees are quite high.

- Customer service is inadequate.

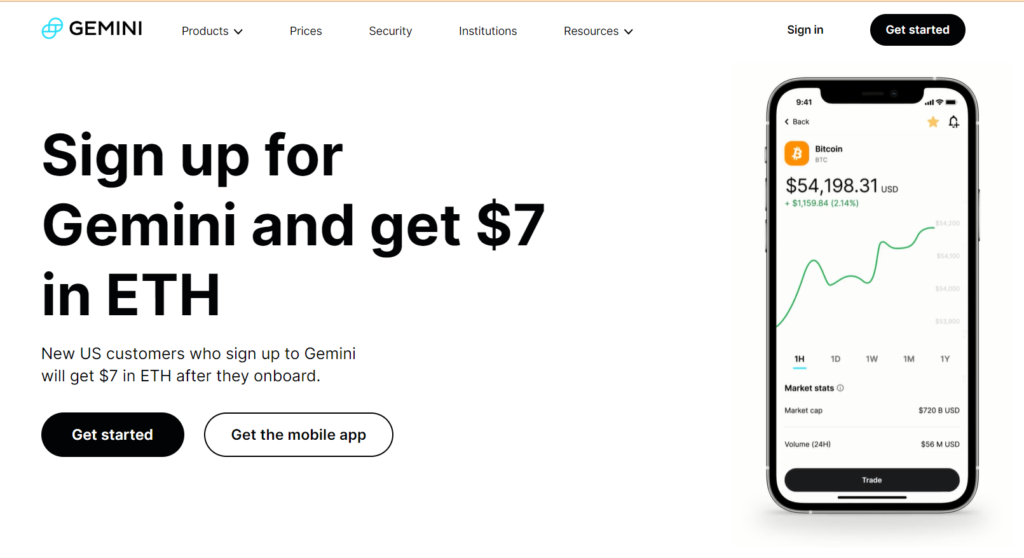

3. Gemini:

Gemini, designed for advanced traders, offers an excellent buying and selling dashboard and endorses over 75 digital currencies and tokens. Gemini also provides a cryptocurrency reward card and the ability to pay for products and services with cryptocurrency.

Gemini helps visitors use two-factor authentication to safeguard their accounts and gives them the alternative to evaluate and authorize the systems they use to access their trading accounts. Gemini also has SOC 2-certified safety, which implies that third-party auditors have confirmed the company’s security and compliance structures.

Payment systems differ between Gemini’s main platform and productive trader forums. The main system costs fixed fees for small trades and a very high 1.49 percent fee for trades over $200. Maker-taker fees of up to 0.4 percent are charged by the active trading company, with fees decreasing as your volume increases. These are also on the expensive side. However, the relatively high fee may be a small price to pay for Gemini’s extremely strong safety.

Gemini is ideal for traders and investors who prefer to trade on a highly secure platform.

Pros:

- Users in all 50 US states can access it.

- Highly liquid exchange

- Protects funds in a hot wallet

- Secure framework.

Cons:

- Many trades have high fees.

- Endorses fewer cryptocurrencies than many competitors

4. BitMart:

BitMart, which was founded in the Cayman Islands, has turned into the biggest trading platform for low- and medium cryptocurrencies. BitMart has more investments and trading pairs than its business peers, so investors looking to add newly announced or obscure crypto assets to their portfolios will most likely find it on this exchange.

Furthermore, BitMart customers could use the Paid component of the exchange to generate a return on crypto assets held with the exchange. When holding the exchange’s native token, BMX, users can also get trading fee discounts.

Whereas BitMart has a great deal to offer skilled crypto traders, the exchange has earned some poor. For example, several Trustpilot users complained about withdrawal issues, poor customer service, and a lack of transparency. However, there are some positive comments as well.

BitMart has guaranteed to refund consumers; the hack has severely harmed the exchange’s public image. Furthermore, in December 2021, BitMart experienced a security issue that destroyed $196 million in consumer funds.

Pros:

- Supports a huge number of cryptocurrencies

- Offers cryptocurrency career choice

- Provides a straightforward buy/sell cryptocurrency component

Cons:

- In 2021, there was a huge hack

- Has received poor customer feedback

5. Kraken:

Kraken has two systems: its major trading platform and Kraken Pro, its professional framework. The Pro dashboard on the exchange offers highly customizable chart analytical techniques, a comprehensive understanding of order books, 13 order types, and high-speed operation.

Kraken consumers can trade cryptocurrency on margin and execute crypto derivatives trading systems further to the cash market. Whereas immediate buy fees on Kraken’s main platform can reach 1.5 percent, fees on Kraken Pro are extremely low. Kraken Pro has a tiered fee schedule, which enables greater traders to save money on trading costs.

Kraken Pro’s producer fees begin at 0.16 percent and taker fees begin at 0.26 percent for traders with 30-day volumes of less than $50,000. Maker fees, on the other hand, can be as low as 0%, and taker fees as low as 0.10 percent (for traders with 30-day rolling amounts of more than $10 million).

Furthermore, Kraken’s financing options are limited, with wire transfers being the main form of payment for Kraken users. ACH transactions are not accepted.

Pros:

- A significant number of cryptocurrencies are endorsed.

- Kraken Pro has low fees.

- The exchange is extremely liquid

Cons:

- Not accessible in all states in the United States.

- Account financing options are limited.

6. Cash App:

Cash App, founded in 2013 by Block, Inc. (formerly Square, Inc.), enables people in the United States and the United Kingdom to send, spend, bank, and invest money. It’s largely a mobile banking app focused on peer-to-peer payouts, but it also includes an investment component. Through the Cash App, consumers can invest in stocks, ETFs, and Bitcoin.

Apart from its competitors, such as Robinhood and Venmo, Cash App allows users to withdraw Bitcoin to third-party wallets, which sets it apart from the contest. Cash App CEO Jack Dorsey reported in early 2022 that the corporation has begun to roll out assistance for the Bitcoin Lightning Network, enabling near-instant Bitcoin transfers at almost no expense. Even so, since you can withdraw your Bitcoin from the Cash App, you can transfer it to an individual wallet in which you control the secret keys.

The Bitcoin exchange fees on Cash App vary and are only displayed when you are asked to verify your buy or sell transaction. When you start trading bitcoin with Cash App, the mid-price is used and a spread fee is added.

Pros:

- Simple interface.

- Withdraw to your wallet.

- The Bitcoin Lightning System is supported.

Cons:

- Only accepts Bitcoin.

- Custody wallet

- Limits on deposits, sales, and so on

7. Bisq:

Bisq, which was launched in 2014, is accessible crypto exchange software that allows people all over the world to trade a variety of digital currencies and tokens on a peer-to-peer basis. Over 100 digital assets are officially supported.

Users are not required to accomplish a Know Your Customer (KYC) identity verification system, and the trading software is not restricted to customers in specific jurisdictions. People can purchase and sell Bitcoin and other cryptocurrencies on Bisq using a variety of financial services, such as bank money transfers, ACH transfers, and cash deposits.

Whereas Bisq is common among many early cryptocurrency adopters because it upholds many of the attributes on which Bitcoin was founded, such as decentralization, confidentiality, and sovereignty, the exchange is not for beginners. The escrow method used in peer-to-peer trading may be difficult for new customers, and the relatively slow trade implementation may deter first-time consumers and active traders.

Furthermore, because transaction volumes are relatively lower than on centralized global exchanges, the transfer is more geared toward making smaller deals.

Pros:

- It is widely accessible.

- Provides a high level of privacy and does not involve ID verification.

- Payment options number in the hundreds.

Cons:

- Transaction times can be lengthy.

- Trading volumes can be minimal.

- It is not intended for active trading.

8. BlockFi:

BlockFi is a cryptocurrency exchange and framework that provides a cryptocurrency wallet, cryptocurrency trading, cryptocurrency-backed loan payments, and a cryptocurrency incentives credit card. Customers outside the United States can also open a BlockFi Interest Account and start investing in their investments.

BlockFi allows the user to take involvement in your cryptocurrency and borrow USD against it. BlockFi also allows you to trade cryptocurrencies. They presently trade a limited amount of cryptocurrencies, including BTC, ETH, LTC, USDC, and GUSD.

BlockFi offers loans USD against your deposited coins. The loan balance must be at least $10,000. The loan-to-value (LTV) ratio is 50%. That indicates you’ll have to put up 50% of your coins as collateral.

BTC, ETH, and LTC are examples of coins that can be used. The term of the loan is 12 months, and the rate of interest is 4.5 percent. There may also be incorporation costs.

Bonus Offer: Currently, if you open a BlockFi account and make an eligibility payment of $100 or more, you can receive a $250 bonus!

Pros:

- There are no commissions or fees.

- US-based and governed.

- Earn a lot of money on your deposits.

Cons:

- Doesn’t cover a wide variety of tokens and coins

- Free withdrawals are restricted.

9. Binance:

Binance is a cryptocurrency exchange premised in Malta that was established in 2017 (in China). It has operations in the United States and Singapore. Binance is the world’s largest crypto trading framework, both in volume terms and weekly site visits, according to CoinMarketCap.

Binance consumers can trade, buy, and store cryptocurrency. Individuals can choose between basic and advanced trading platforms. It also provides institutional trading with a fee schedule based on the volume.

Binance does have its software wallet, the Trust Wallet. It claims to support 40 blockchains and more than 160k assets. It also has excellent feedback on both iOS and Android. Customers, moreover, do not need to use the Trust Wallet. You can transfer your investments to any cryptocurrency wallet of your choice.

Binance charges a 0.1 percent trading fee for the majority of pairs, which is less than the fee charged by many other transactions. The fee for instant buy/sell trading is 0.5 percent. Binance provides marking (with annual rewards ranging from 0.5 percent to 10%).

Pros:

- A large number of coins and tokens are endorsed.

- Transactions are processed quickly.

- Fees are low.

Cons:

- In comparison to the rest of the world, the United States has few options.

- Not all 50 states have it.

- Customer service is limited.

10. Uphold:

Uphold (previously Bitreserve) is a cryptocurrency trading system that provides cross-asset trading. It was established in 2014 (name changed) and is headquartered in San Francisco, California. Halsey Minor, the company’s founder, has left the company. J.P Thieriot is the CEO. Uphold has lifted $15.5 million in a Series B round.

Uphold is a worldwide feature that enables users to convert fiat currencies, cryptocurrencies, and a few commodities and (mostly tech-related) stocks. You can connect them from your mobile device almost anywhere except the OFAC countries.

Uphold earns profit on transactions through the expansion. The distinction between the bid and the ask. According to Uphold, its spread on BTC and ETH is typically 0.8 percent to 1.2 percent and 1.8 percent in the United States and Europe.

Uphold advises about other digital currencies. Spreads on low-liquidity crypto and tokens can be considerably higher. Before you trade, check the prices at Preview. Spreads for these other exchange rates and commodity markets presently vary from 0.65 percent to 3.95 percent.

Pros:

- A concise and credible pricing structure

- There are numerous crypto tokens and even stocks, including popular ones like XRP.

- Both desktop and mobile apps are available.

Cons:

- Not as simple to use as others on this list.

- There have been some reports of poor customer service.

11. eToro:

eToro (eToro USA Ltd.) is a social trading platform for cryptocurrency. Yoni Assia is its co-founder and CEO. The corporation was formed in 2007 and is headquartered in Hoboken, New Jersey. Cyprus, Israel, and the United Kingdom are its certified departments. eToro is a privately held company. Its most recent round of funding was a $50 million Series E.

eToro is a trading service that allows users to trade stocks, cryptocurrency, commodities, and other assets. As a “social trading” framework, eToro allows investors to easily replicate the trades of other top market participants on the forum.

Whether you want to start investing in Bitcoin or learn trading systems from professional ones, eToro might be a wonderful way to broaden your investment opportunities and increase your horizons.

The potential to copy trades in genuine is a big draw for eToro. CopyTrader lets you choose a trader and duplicate all of their transactions. This implies that the framework will exchange the same deals as your copied trader.

Pros:

- Global cryptocurrency exchange options

- Capability to replicate other traders’ portfolios

- To begin, set low minimums.

Cons:

- There are few choices in the United States.

- Only 41 US states have it.

- Supports fewer tokens and coins than the other systems on this list

12. Bitcoin IRA:

Bitcoin IRA has devised an easier solution to these issues. Customers only need to open a Bitcoin IRA account and introduce an IRA transfer. The rest will be taken care of by Bitcoin IRA. Customers can begin trading cryptocurrencies in their IRA once the procedure is finished. Let us see how it goes.

Bitcoin IRA is a one-stop shop for trading cryptocurrencies directly from your IRA. The corporation is a full-service, self-directed IRA provider, which distinguishes it from the many other corporates that would provide similar programs by cobbling together several pieces.

Bitcoin IRA has just released a mobile app for Apple and Android devices. According to Bitcoin IRA, it is the world’s largest first app that enables users to trade cryptocurrencies within a self-directed retirement account. The app also allows you to view advanced charts, set up custom price alerts, and do other things.

Bitcoin IRA offers the following to its customers:

The conversion of an existing IRA to a Bitcoin IRA

24/7 cryptocurrency trading

Reporting — financial and operational remarks

Pros:

- Engage in cryptocurrency through your IRA.

- The opportunity to raise interest on your cryptocurrency within your IRA

- Options for maximum security

Cons:

- Minimums are high.

- Supports fewer tokens and coins than the other systems on this list

13. Hodlnaut:

Hodlnaut is a framework for cryptocurrency lenders. Juntao Zhu is its Co-Founder and CEO. Hodlnaut was established in 2019 and is headquartered in Singapore. It is also a company in the Antler portfolio.

Classically, Bitcoin owners will only be able to make money from the investment in off-price incremental increases. At the same time, they’re looking for ways to enhance the comeback of their investments while they wait for their price to increase.

Hodlnaut provides institutional clients with digital asset loans. The loan amount starts at $50,000. Hodlnaut is the Institutional Loans counterparty. Terms are available for at least three months. Loan-to-value ratios are typically 70% or less.

Check out Hodlnaut if you’re searching for a cryptocurrency trading potential substitute. Hodlnaut is a framework for investments and borrowing that concentrates on Bitcoin as well as several stablecoins. You can earn significantly up to 4.08 percent on your Bitcoin and 7.25 percent on your USDC by saving and lending on their forum.

Pros:

- Continues to pay a high rate of interest on assets

- There are no minimum balance prerequisites.

- When you deposit $1,000, you will receive a $20 bonus.

Cons:

- Only BTC, ETH, DAI, USDC, and USDT are supported.

- Assistance is based in Singapore and may react slowly.

14. Abra:

Abra is ideal for mobile-forward cryptocurrency traders, who appreciate both the liberty to trade a wide variety of cryptocurrencies and the safety of ensuring those investments remain secure. The framework is also ideal for users who require low-interest loans.

Abra allows you to trade over 100 different cryptocurrencies, including Bitcoin, Dogecoin, Ethereum, Litecoin, and others. Crypto connectivity varies by country, but Abra provides this resource with specific restrictions.

Abra also provides storage for mobile wallets. After you set up the wallet, you’ll be given a digital recovery phrase, and Abra provides investors with absolute control over their investments by ensuring that only consumers have access to the mobile wallet’s recovery phrase.

100+ cryptocurrencies, crypto-backed loans, staking, and support for traders in 150+ countries are among the features. The minimum deposit for an account is $5; minimums vary by cryptocurrency.

Pros:

- There are no charges to trade 100+ cryptocurrencies (excluding the spread fee).

- Borrowing against crypto assets is possible, with repayment interest rates ranging from 0% to 9.95%.

- Earn up to 10% interest on cryptocurrency or USD stablecoins.

- Assistance is required in 150+ countries, with access to 50+ fiat currencies.

Cons:

- Expensive fees for Visa and MasterCard transactions

- There is a lack of accountability regarding the exact exchange spread prices.

15. CEX.IO:

According to its website, CEX.IO is a worldwide crypto exchange based in London that supports traders in more than 99 percent of the world’s countries, including 48 US states. The exchange also connects directly to Bitcoin and over 100 other cryptocurrencies.

It’s also worth noting CEX.IO’s fee structure. The maker/taker schedule on the exchange is premised on your 30-day trading activity. Maker orders cannot be executed immediately because no other orders are available to match them; however, taker orders match instantly, as per CEX.IO.

It charges maker fees ranging from 0.00-0.15 percent and taker fees ranging from 0.01-0.25 percent. CEX.IO is also available on iOS and Android devices.

Pros:

- 100+ assets, which include Bitcoin, Ethereum, and others (US users can currently trade more than 40 cryptocurrencies).

- Fees are low.

- Individual crypto-backed loans, margin trading, and staking rewards

- Businesses and advanced traders can benefit from systemic services.

- Customer service is available 24/7, and mobile access is available.

Cons:

- Limited coin selection (CEX.IO offers more tokens).

- For US traders, staking rewards, crypto-backed loans, and savings features are not available.

- Services are not available to New York residents (a complete list of CEX.IO’s geographic limitations can be found here).

Conclusion:

Investing in Bitcoin is similar to investing in securities. To use BTC, you must first set up an account with an exchange. You create an account with a brokerage firm to trade stocks. The finances are then deposited.

The only distinction between making an investment in Bitcoins and trading BTC is that you must first purchase BTC with deposited funds until you can trade BTC. However, your initial BTC purchase is your first open trade.